Dear UnitedHealth Stock Fans, Mark Your Calendars for July 29

/Unitedhealth%20Group%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

After a challenging year for healthcare stocks, all eyes are on UnitedHealth Group (UNH) as it prepares to unveil its second-quarter earnings on July 29. Once a stalwart of defensive investing, UnitedHealth has seen its stock tumble nearly 45% year-to-date, making it one of the worst performers in the S&P 500 Index ($SPX). Although its first-quarter revenues of $109.6 billion showed modest growth, rising medical care ratios and suspended full-year guidance have left investors on edge.

Will UnitedHealth’s upcoming results mark the beginning of a comeback or signal more turbulence ahead? Let’s find out.

UnitedHealth’s Recent Financials

UnitedHealth Group (UNH), a global health benefits and services company, commands a market capitalization of $272.7 billion. The company remains a favorite among income-focused investors, offering an annual dividend rate of $8.84 per share and a yield of 3.03%. It has endured a sharp decline, down 42% year-to-date and 43% over the past 52 weeks.

UnitedHealth trades at 10.88x trailing earnings and 13.92x forward earnings, both well below the sector medians of 17x and 17.49x, respectively. This discount reflects heightened uncertainty but also offers potential value for investors seeking quality at a lower multiple.

On April 17, UnitedHealth reported first-quarter financials that highlighted both resilience and challenges. Revenue climbed $9.8 billion year-over-year to $109.6 billion, driven by the company’s ability to serve more people across both its UnitedHealthcare and Optum businesses.

Earnings from operations totaled $9.1 billion, while cash flows from operations reached $5.5 billion. The company returned nearly $5 billion to shareholders in the quarter through dividends and share repurchases, and its return on equity stood at a robust 26.8%, highlighting efficient use of capital.

Operationally, the medical care ratio rose to 84.8% from 84.3% a year earlier, mainly due to ongoing Medicare funding reductions, changes in member mix, and increased senior care activity. These pressures were partially offset by changes to the Medicare Part D program, which also contributed to a reduction in days claims payable to 45.5 from 47.1 in the first quarter of 2024. Meanwhile, the operating cost ratio improved to 12.4% from 14.1%, reflecting gains in technological and operational efficiency.

Reflecting on the quarter, then-CEO Andrew Witty noted, “UnitedHealth Group grew to serve more people more comprehensively but did not perform up to our expectations, and we are aggressively addressing those challenges to position us well for the years ahead, and return to our long-term earnings growth rate target of 13 to 16%.”

Strategic Shifts Shaping UNH’s Upcoming Earnings

As UnitedHealth Group approaches its July 29 earnings release, analysts are keeping a close eye on the company’s next moves, especially after a year that’s been anything but predictable. The company’s decision to suspend its 2025 outlook, citing higher-than-anticipated medical expenditures, has injected a dose of caution into the market. Still, management has made it clear that they expect to return to growth in 2026, setting the stage for a potential rebound.

For the current quarter ending June 2025, the consensus earnings estimate stands at $5.08 per share, down sharply from $6.80 in the same period last year, a steep 25.3% year-over-year decline. The full-year 2025 forecast is similarly downbeat, with analysts projecting average earnings of $21.76 per share versus $27.66 in 2024, reflecting a 21% drop.

In parallel, UnitedHealth is sharpening its operational focus by announcing plans to exit Latin America through the sale of its Banmedica operations for approximately $1 billion in 2025. This move is designed to cut costs and strengthen the company’s financial position, allowing more resources to be directed toward core U.S. markets and strategic growth initiatives.

Analysts Views on UnitedHealth’s Path Forward

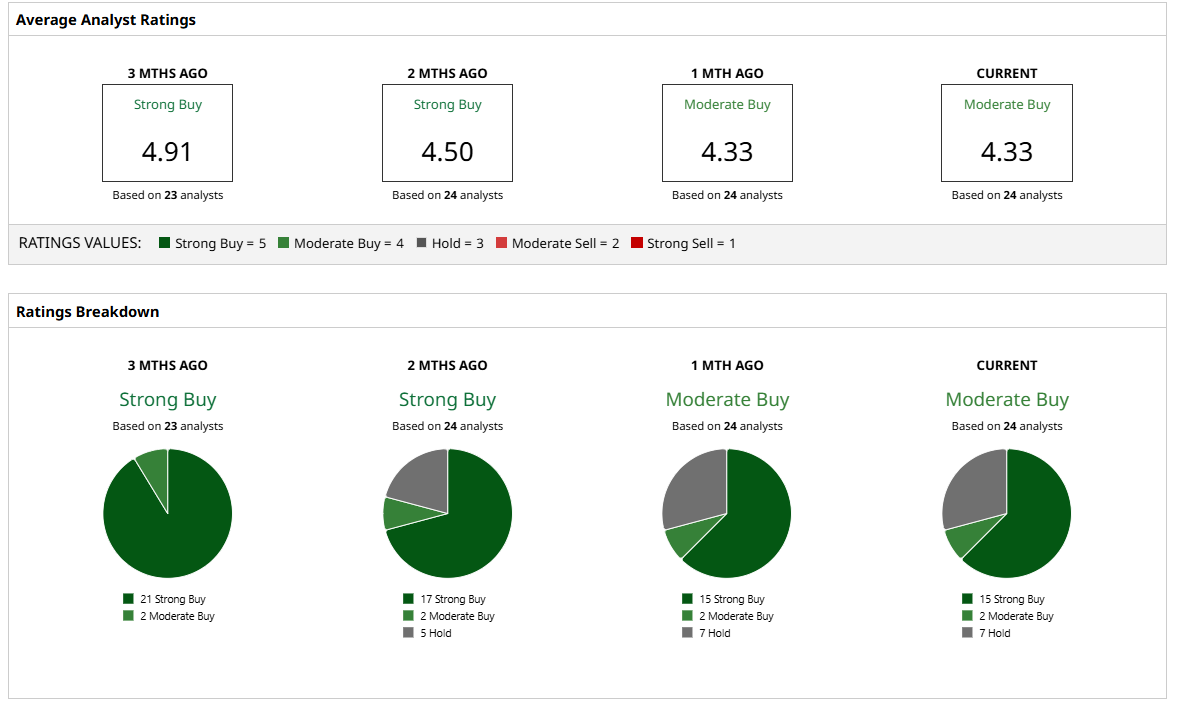

Despite these headwinds, analyst sentiment remains surprisingly upbeat. The 24 analysts surveyed currently rate UnitedHealth as a consensus “Moderate Buy,” signaling broad confidence in the company’s long-term fundamentals and its ability to execute through the cycle. The average 12-month price target sits at $361.24, which represents 24% upside from the current share price.

Conclusion

UnitedHealth’s upcoming Q2 report is a real fork in the road for this battered stock. After a nearly 45% drop this year, the pressure is on, but with analysts still calling it a “Buy” and price targets averaging around $361, there’s a sense that the worst could be behind it if management delivers updates that point to a credible turnaround.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.